Cruising comfortably at a healthy clip of 11% CAGR for domestic travel, and expected to grow exponentially in line with the growth of an aspirational middle class, we had forecast to grow our fleet of 650 aircrafts to 1100 by 2027 and 2380 by 2038. We had planned for adding another 100 airports in the next 20 years to meet the anticipated demand. Our major entry points at Delhi and Mumbai had long surpassed their capacities. We had interest from the French to setup a MRO facility and international bids for the new Jewar airport. Private sector had evinced interest in investing in the required infrastructure. Anticipating the huge potential we had also increased FDI to up to 100% on approval basis.

India had the potential to be the third largest aviation industry in the World. We were well on our way towards that , till the industry skid, thanks to Covid.

Now we have one airline with 70% market share and the others barely surviving. Post Covid normalisation, when the traffic returns, we may not have the airlines to meet the demand which is expected to surge; resultantly, we may have high fares in a monopolistic situation. Surely, the void would be filled up thru new entrants but they may enter only after a lag and may have to go thru the same cyclicality and competitive pressures. Net net, the customer would suffer.

There is no certainty for the return to normalisation of this sector. We may not need 650 planes in the absence of passengers and in the face of continued restrictions, the allied activities of passenger services at the terminals, catering, etc would also suffer rendering them unviable and leading to job losses.

At the same time, we cannot wish this sector away or allow it to wither. Several countries have extended multi billion dollar support to this sector by way of loans, grants, subsidies, refund of fees, cess and taxes, and in case of Singapore Airlines, even capital infusion thru Temasek. In India, we are still mulling over the issue.

This sector has limited facilities from Indian banks and anyways the banks, after their not so happy experience with some players, are not too keen to increase their exposure. Restructuring of this meagre liability is not going to address their predicament.

The questions to be addressed are:

- Do we need this sector at all?

- Can we afford to have a setback to this sector by at least half a decade, if not more?

If we do not need this sector and can do without it for the next 5 to 6 years, we need to do nothing and leave it to the market forces. On the other hand, if we accept, that this sector contributes significantly to employment and the GDP, directly and indirectly, thru tourism, logistics, hospitality, etc sectors, then some immediate intervention maybe required.

More importantly, we must also accept the structural infirmities that have plagued this sector for the last 7 decades, of course accepting the security risk associated in its unfettered ownership and consequent liberalisation.

But, every crisis offers an opportunity, and given the global economic and trade issues presently, it is, perhaps, as opportune a time as any for us to capitalise on its potential thru some out of the box measures .

This sector requirers capital, both debt and equity and that too at competitive rates to survive and flourish. This capital is presently unavailable in India due to relatively high interest rates and inflation expectations. While most of the revenues in this sector are Rupee denominated, the liabilities are in hard currency and at multiple stages require conversions and are therefore subject to exchange volatilities. In India, we have mostly operating leases from aircraft leasing companies established in tax havens. Our carriers have placed orders for almost 700 planes to be delivered in the next 5 years. Most of would be sold and leased back from multiple leasing companies in disparate tax geographies. Often, these transactions have been quite opaque as we have seen in the case of two failed aviation companies in India.

So what could be a possible solution?

While our airlines are struggling to survive, the aircraft leasing companies in tax havens are able to offer relatively decent returns on both debt and equity capital to their investors. The Chinese have been the biggest beneficiaries as they have been both lessees as also the investors. This might abate soon as more and more Chinese orders would go to their own manufacturers.

India would be one the biggest purchasers of aircrafts for the next 15 years, after USA and China. It would be a good opportunity for India to negotiate with the two major manufacturers for bulk orders provided they shift major manufacturing to this country. With this shift, MRO’s would expectedly follow as certifications could then be also handled locally.

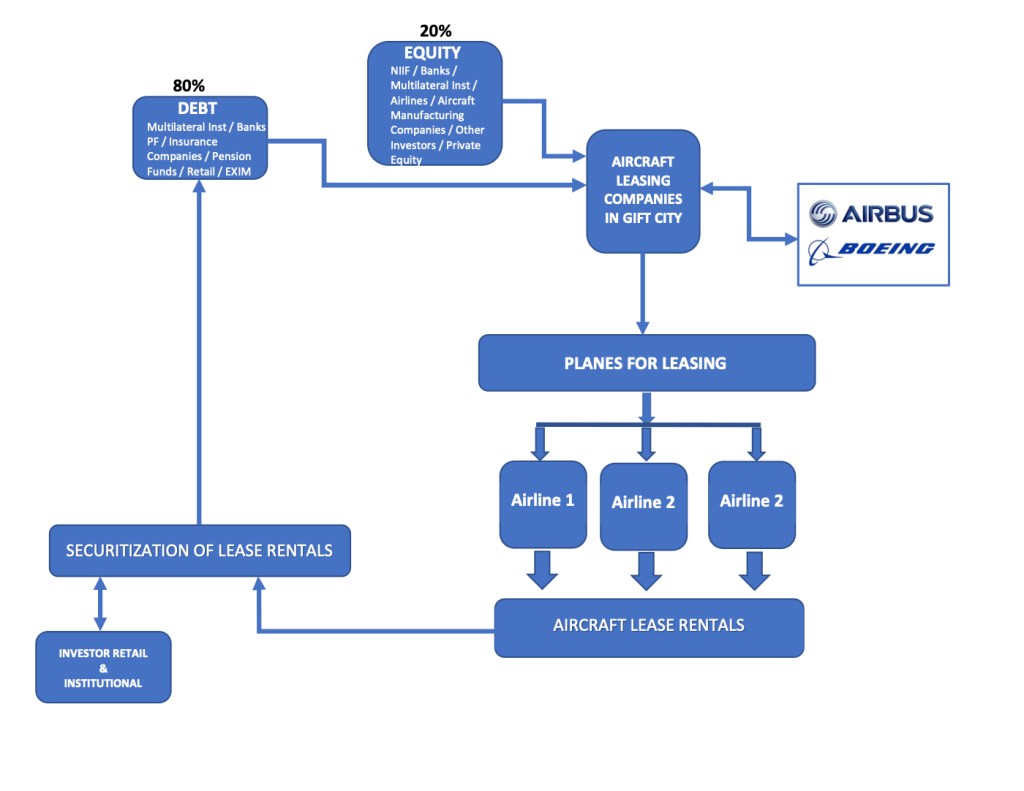

Who will purchase these aircrafts? The constraint is Capital. Either we allow unfettered entry of foreign carriers thru the 100% FDI route or think of an alternate solution. Finding entrepreneurs who will be able to raise the requisite capital in India appears to be difficult presently. Alternatively, we could think of an aircraft leasing entity to be incorporated in GIFT city with equity contribution from NIIF, multilateral institutions,Banks, airlines, and leverage that with bond issuances subscribed by pension, PF and insurance companies for the purchase of 1000 aircrafts over next 10 years, post normalisation. This would translate to an aggregate funding requirement of roughly USD 40 Bn over ten years. Assuming a leverage of 10x, this would require a capital of USD 4 Bn and debt of 36 Bn over the period. Assuming, delivery of 100 aircrafts in a year, this would mean USD 400 Mn equity and USD 3.6 Bn debt in the first year. And thereafter based on rental income and profits, these requirements would reduce progressively. While it may be difficult to raise the USD 40 Bn domestically, it would be possible to raise the amount required for the first 2-3 years, and based on the revenue streams which stabilise thereafter encourage participation from other investors including those from outside the country who would be willing to take the currency risk.

How do we reduce the cost of capital? Through tax interventions and a dedicated tax regime for GIFT City including:

- rental income – exempt from all taxes, IT, GST

- No import duties, stamp duty Registration charges on aircrafts and spares

- banks and other debt investors – tax benefits

- depreciation – allow for full deprecation over 8 years.

Benefits envisaged:

- Shifting aircraft manufacturing or major part to India from China and other countries will lead to major vendor development, employment, revenue and taxes for the country.

- Bulk order on behalf of the aircraft leasing entity established in India will help reduce cost of acquisition, and also reduce forex outflow on account of rentals every year.

- Establishment of MRO would reduce forex outgo and provide further employment and specialisation.

- The aircraft leasing and MRO facilities could be developed as regional centres.

- End of life aircraft salvage and recertification facilities could also be shifted here on account of low labour costs and presence of airline manufacturing facilities providing further jobs and specialisation as also recycling scrap locally.

- It would encourage multiple players to enter the aviation sector by reducing the total cost of business, they could operate on a balance sheet light model and use the surplus capital to maintain minimum liquidity and grow from regional, zonal to national levels progressively improving connectivity at competitive fares.

- Spares could also be centrally available, reducing the cost for each airline.

- Alternate investment opportunity for Indian savers thru securitisation of lease rentals

- Exchange risks would be reduced thru domestic lease rentals for the airlines and for the aircraft leasing company to the extent of the domestic funding.

- Opacity and revenue losses in sale and lease back transactions would be addressed.

- Banks would be financing against asset owned by the domestic aircraft leasing company – aircrafts and spares, and not against spares of each airline. Since interest on their loans would have a tax exempt status, treating it as an infrastructure sector, this would give a fillip to the entire industry. These loans could be repaid thru securitisation or InvIT routes, garnering retail participation in bonds markets in the country. These bonds could also come with partial guarantees from multi lateral institutions .

- Tourism, services, hospitality, and other related structures would resurge.

As Winston Churchill said, “Never let a good crisis go to waste”.

Ackd: CAPA & IBEF

Disclaimer : This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organizations that the blog owner may or may not be associated with in professional or personal capacity, unless explicitly stated. Any views or opinions are not intended to malign any religion, ethnic group, club, organization, company, or individual.

An excellent remedy by a experienced Banker to the ailing aviation sector . Govt should take recognition of some of the important suggestions so that the aviation sector gets the necessary impetus to rebound to Profitability in the Post Covid era

LikeLike