Pursuant to the recent publication of the draft guidelines by Reserve Bank of India for sale of loan assets on the 8th of June 2020, I’m sharing thru this blog, a piece written on the same subject and an article jointly authored with Mr Anand Sinha (retd. Deputy Governor RBI) on 30th January 2019

The Case for an Alternate Credit Delivery System

The rising expectations of a young population in India would require a sustained GDP growth over the next two to three decades. At a modest growth rate of 5.5% p.a., we should hope to become a USD 7.5T economy in the next 20 years. While consumption may fuel short term GDP growth, long term stable growth requires investment rates to go up north of 30%. Infrastructure investments of USD 4 to 4.5T may be required over the next twenty year leading to demand for investments across various other sectors. In turn, increasing the appetite for credit to fuel this growth.

The NPA situation will diminish and stabilise, hopefully over time. Banks which today are, maybe loathe to add any fresh exposures in corporate banking as also infrastructure financing, will perhaps, return to financing these, initially with tighter underwriting standards which over time may become lax. History has proven, even in advanced economies, the proclivity of bankers to have short memories, succumbing to greed and reinventing the wheel of mistakes, perhaps newer ones, time and time again. It is imperative, therefore, to consider alternatives to the present credit delivery mechanism to avoid a repeat of the past mistakes.

Let us examine a typical large greenfield / brownfield project financing scenario – A corporate for its funding requirements, either approaches its relationship bankers directly or through intermediaries, depending on its ratings and /or size. Most of the banks wait for the sanctions of a few large players before considering their participation. The financial closure depends on the sanction of the last participant following which documentation and disbursal takes place, with the corporate or its intermediary again doing the rounds for completing the related formalities. RBI has withdrawn its guidelines for consortium lending and banks have not devised a common framework, neither by themselves nor through IBA. Therefore, quite often, sanctions vary considerably from bank to bank whether in terms, covenants, EOD, penalties, or prepayment conditions. Further, multiplicity of reference rates amongst banks requires harmonisation of interest rates. (The Inter Creditor Agreement ( ICA) recommended by the Sunil Mehta Committee is yet to gain universal acceptability) Resultantly, any rectification, restructuring, resolution, or recovery is a coordination nightmare especially when there are 30 odd banks participating in a consortium. The problem gets further compounded in a multiple banking arrangement where each bank may also have exclusivity on components of the underlying assets/collateral. Factoring in lack of specialisation at the level of the prime participants, the ignorance gets multiplied across the system. A glaring case in point is the inability to sort out the issues involved, inter-se the participating institutions, for the revival of the power sector NPAs. (Even after the June 7th circular of the RBI)

The need of the hour, therefore, is a systemic change in the whole credit delivery paradigm borne more so out of the experiences faced in the existing system, namely

- Both consortium and multiple banking arrangements have had their fair share of problems largely due to disharmony and competing self-interest amongst participants.

- One of the important lessons learnt is that project and greenfield financing is very serious business and requires specialisation to understand and underwrite complex attendant risks. Therefore, sine qua non, only banks with balance sheet strength and specialised underwriting abilities should venture in this area.

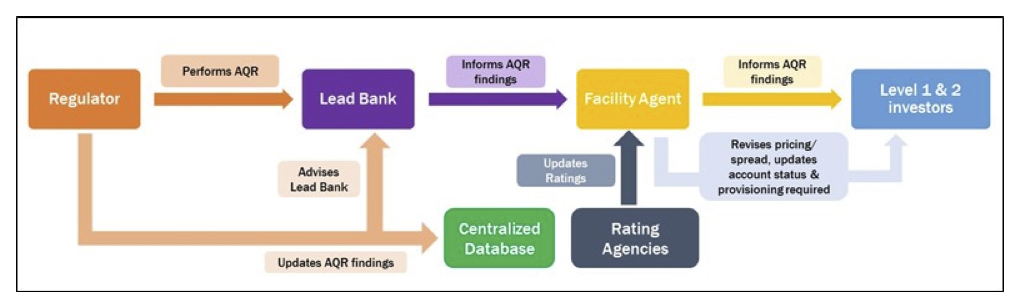

- AQRs done by the regulators in the past have had their fair share of variances inter se participating banks in a consortium or in MBA leading to differing classifications and provisioning requirements for the same asset across banks.

- There could be instances of asset liability mismatch with the participants. However, there is no mechanism to buy or sell such loan assets, and prices depend largely on the desperation of the seller. In essence, there is no platform to facilitate this on a regular basis, rather all deals struck are pretty much episodic and often only bilateral.

We, therefore, need to change our financing mechanisms to meet the emergent demand for credit. At a bare minimum, make certain institutional interventions based on transparency and information symmetry.

The first few steps in that direction have already been taken, to name a few, setting up and stabilisation of CIBIL & CRILC, and with the Public Credit Registry also in the offing 40% of the cash credit borrowings for borrowers with working capital limits of Rs 150cr and above to be termed out, co lending norms for NBFCs and banks in the priority sector, benchmark rates for small and medium enterprises and personal loans, TREDS platform for receivables discounting, etc. However, many more structural dispensations are required, specifically in relation to large exposures; To illustrate:

- Alignment of the credit markets across loans, bonds, and treasuries

- Development of a reference rate – to provide harmonisation of spreads across players and to facilitate documentation and transferability

- Common loan agreement and common covenants – to facilitate transferability, faster disbursal, and legal resolution

- A platform to enable participation in the loans by various players, including banks, HNIs, FPIs, and to also facilitate transferability though assignment or securitisation

- Compulsory security trustee arrangement for all shared exposures

- Compulsory fiscal and transfer agents for all shared exposures

- Compulsory and uniform security identification protocol for all shared exposures

- Single point annual asset review

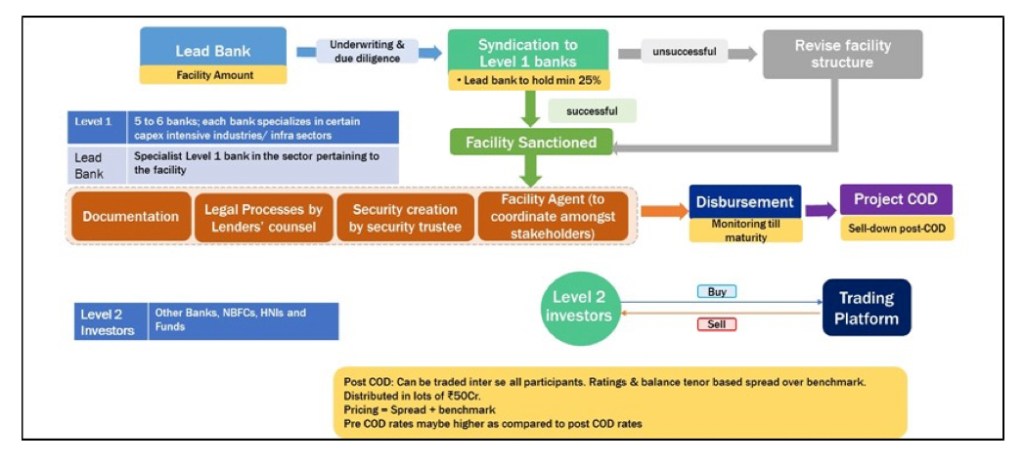

An alternate credit delivery system for large projects can be proposed on the following lines:

- There are 21 public sector banks (this was before the last round of mergers) and an equal number of private and foreign banks. All large corporate loans above Rs 2000cr could be underwritten by one of top five or six banks, say SBI, ICICI, HDFC, BOB , PNB, AXIS for instance, who could develop sectoral expertise for due diligence, underwriting, and monitoring. These may be called the Level 1 banks. These loans could be brownfield / greenfield / infra exposures.

- The lead bank would underwrite 100% and hold till maturity at least 25% of the exposure.

- The loan would require to be syndicated for at least 50% of the exposure else it would devolve on the underwriting bank which would be required to hold the exposure on its books till C.O.D with an enhanced regulatory provisioning requirement. Such a provision may lead to a revision in pricing or terms, conditions, covenants, etc. ensuring that the pricing is aligned with the attendant risks as perceived by the participating banks and not only by the lead bank, and perhaps ensure the success of the syndication. All the participating Level 1 banks would continue to hold greenfield and infrastructure loans till project C.O.D.

- The loan could be priced differentially pre and post C.O.D, with the spreads linked to a common benchmark which could be the average of the MCLRs of the Level 1 banks. (Perhaps repo linked EBR could be a useful revised reference) The security could be created through a security trustee, and to facilitate coordination, inter se, a facility agent could also be appointed. Disbursals would be strictly controlled by the lead bank ensuring compliances of conditions precedent. All other services, legal, etc. could also be outsourced facility wise. Revisions in interest rate based on movements in the benchmark indices and/or compliance with covenants would be conveyed to the borrower and shared with all lenders.

- Post C.O.D, the Level 1 Banks, may down sell their exposure to the other banks, let’s call them Level 2 banks, or in the bond markets to other investors, including funds, and HNIs, through novation/assignment. At this stage, the project risk would be over, and with the economics of the project stabilising, rating assignments and realignments with pricing would be possible.

- The loan could then be allowed to be traded inter se all participants based on ratings and benchmark pricing and balance tenor in lots of around Rs 50 cr.

- The Asset quality review could be performed centrally at the level of the originating Level 1 bank, which in any case would continue to hold at least 25% of the exposure till maturity, and disseminated through a centralised database which could be maintained by the regulators and available to the facility agent, the rating agencies, the participating banks, investors etc., similar to the Shared National Credit (SNC) in the United States.

Such a process/structure would help aligning risk to pricing and the same to markets/benchmark, facilitating in the process the creation of a secondary market in loans, and addressing the ALM requirements of the participating banks too.

The time to seed these changes could not be more opportune.

Disclaimer : This is a personal blog. Any views or opinions represented in this blog are personal and belong solely to the blog owner and do not represent those of people, institutions or organisations that the blog owner may or may not be associated with in professional or personal capacity, unless explicitly stated. Any views or opinions are not intended to malign any religion, ethnic group, club, organization, company, or individual.